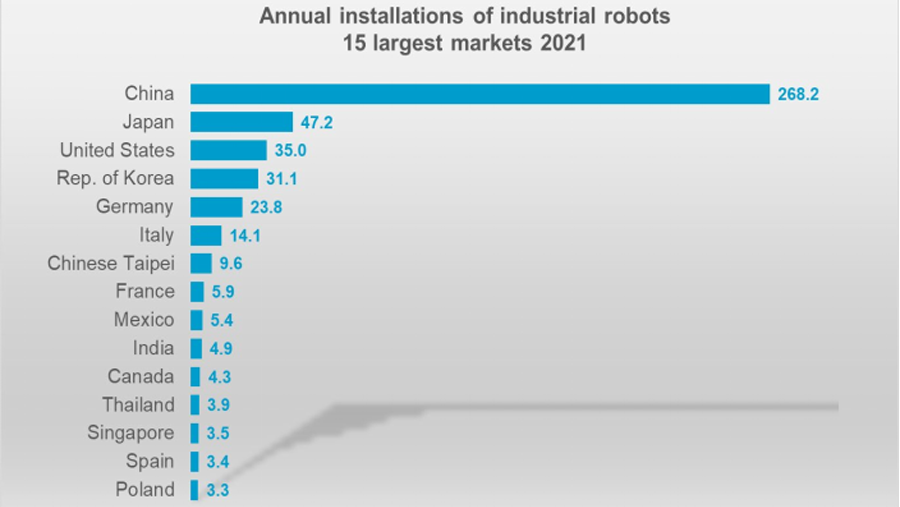

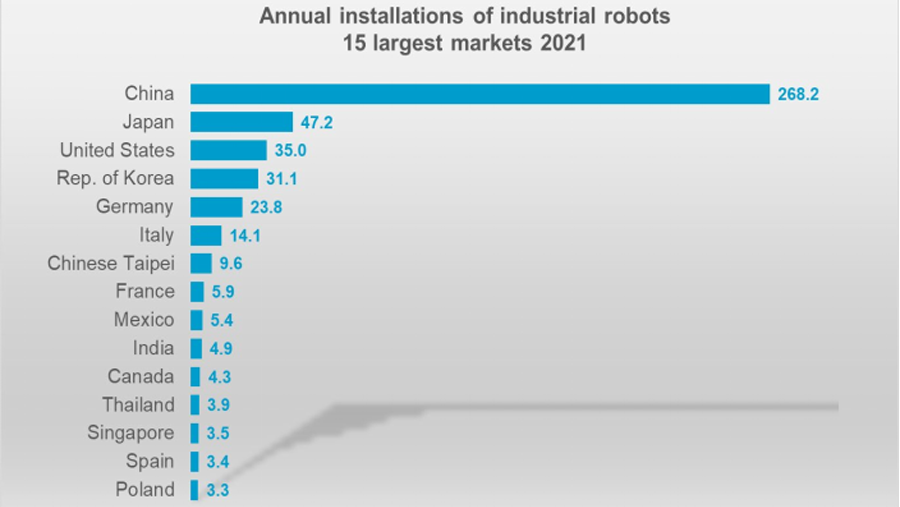

Demand for robots in key user segments shows strong growth in 2021, despite the global manufacturing supply chain being hit hard by the impact of the COVID-19 in the past two years. Driven by the Chinese market, demand for robots will be highest in the electrical and electronics industry, followed by automotive, metal and mechanical engineering, plastics and chemicals, and food.|

rapid cnc machining

The transformation of manufacturing in China, a major manufacturing country, and the labour shortage are driving the growth of the robotics industry and the robotics market. 268,195 new industrial robots were installed in China in 2021, a strong growth of 51%. For the first time, it will account for more than 50% of the global market.

China is the world's leading producer of electronic products, with the electronics sector accounting for one-third of new installations of industrial robots in China in 2021, at 88,153 units, up 56% year-on-year, of which 27% were self-branded.

China is also the world's largest consumer market for automobiles and the largest production base for fuel and new energy vehicles, with huge development potential. Over the years, the automotive industry has been an important driver of robot demand growth, especially the rapid growth of the new energy vehicle industry, ending a three-year decline, with 61,598 new installations in 2021, almost double the number in 2020 and exceeding the historical peak level of 42,396 in 2017. The share of installed base in the automotive industry in 2021 is 26%.

In 2021, the number of robots installed in the metal and machinery manufacturing industry increases by 60% to 34,476 units. This represents 13 per cent of the total installed base. In the metal and machinery manufacturing industry, own-brand robots account for 66%.

In 2021, Japan continues to be the second largest industrial robot market in the world, achieving a 22% growth rate to 47,182 units in 2021, despite two consecutive years of declining new machine installations in 2019 and 2020; in-use holdings were 393,326 units, up 5% year-on-year. Japan is not only an important application market, but also the world's leading robot producer, with its industrial robot exports reaching an all-time peak of 186,102 units in 2021.

In 2021, the US has 34,987 new installations, up 14% year-on-year. This is slightly above the 2019 level of 33,378 units prior to the new crown epidemic, but still significantly below the all-time high of 40,373 units in 2018.

The automotive industry continues to be the number one industrial robot application in the US, with 9,782 new installations in 2021, but down 7% year-on-year, and demand for robots in the automotive industry has declined for five consecutive years. The metals and machinery industry is the second largest application sector for industrial robots in the US, with a 66% surge in installations to 3,814 units. This was followed by the plastics and chemicals industry, in addition to the growing demand for robots in healthcare as a result of the new crown pneumonia.